Gold – bears are pausing ahead of US NFP report

Gold price turned sideways and holding within a narrow range for the second straight day, consolidating after seven-day steep fall.

Larger bears slowed pace ahead of key release of this week – US non-farm payroll report for September- which is expected to generate fresh direction signal.

Gold was deflated by strong dollar on expectations that the Fed would keep high interest rates for longer period, but the latest economic data raised a question mark above signals that the economy is resilient despite strong negative impact from high borrowing cost.

Reports from US labor sector were so far mixed as job openings rose above forecast but hiring in private sector slowed well below expectations.

Focus turns towards the more comprehensive non-farm payrolls report, which will provide more details about conditions in labor sector and generate clearer direction signals.

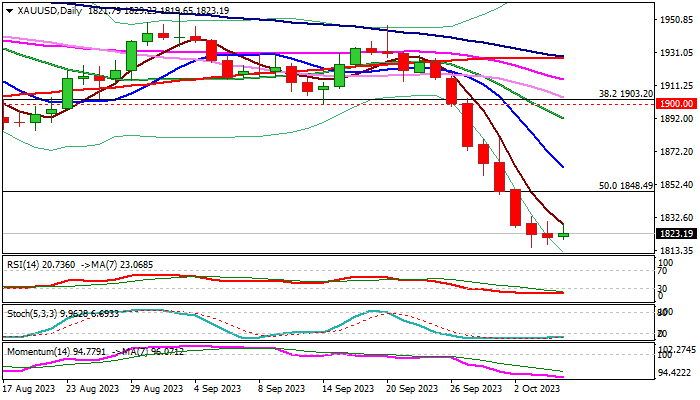

Firmly bearish daily studies are also deeply oversold and point to a pause in recent steep downtrend, which found temporary footstep at 200WMA ($1814).

Consolidation was so far narrow, with initial direction signals expected on break of $1862 (falling10DMA) at the upside, or dip below $1814/04 (200WMA / Feb 28 trough) on the downside.

Res: 1830; 1848; 1862; 1885

Sup: 1814; 1804; 1793; 1765