EURUSD – increasing risk of further weakness

EURUSD is consolidating in early Friday after nearly 0.9% drop on Thursday, sparked by higher than expected US inflation in September, which revived concerns that the fight with inflation is not over yet and added to expectations that the Fed would keep its policy tight for some time.

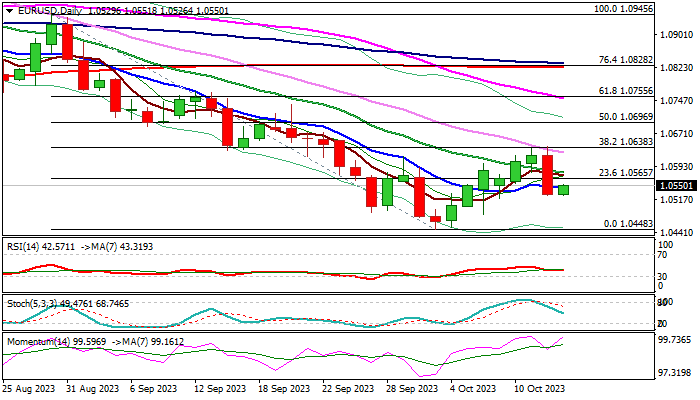

Technical picture returned to full bearish setup on daily chart after Thursday’s loss, as the Euro’s recent recovery stalled at double-Fibo resistance at 1.0640 zone (23.6% of 1.1275/1.0448 and 38.2% of 1.0945/1.0448).

Fresh weakness retraced nearly 61.8% of the recent 1.0448/1.0640 recovery leg, increasing risk of deeper fall after consolidation.

Friday’s close below broken 10DMA (1.0544) to confirm bearish stance and risk retest of 1.0448 (2023 low) and attack at 1.0405 pivot (50% retracement of larger 0.9535/1.1275 advance), loss of which to signal continuation of the downtrend from 1.1275 (2023 peak).

Extended upticks should be capped under falling 20DMA (1.0579) to keep fresh bears in play.

Res: 1.0565; 1.0579; 1.0617; 1.0640

Sup: 1.0526; 1.0482; 1.0448; 1.0405