Gold – bulls take a breather after strong rally on Friday

Gold pulled back from new highest in nearly one month on Monday, as traders collected some profits from last week’s 4.4% advance (only on Friday gold gained 3.3%).

The yellow metal rose sharply previous week, as growing uncertainty amid deepening crisis in the Middle East strongly boosted its safe-haven appeal.

Friday’s rally marked the biggest one-day gains since Mar 17, reflecting very fragile situation with growing threats of escalation of the conflict, though investors expect support to metal’s price to ease if the conflict remains within the current boundaries and likely to accelerate stronger if the conflict spreads.

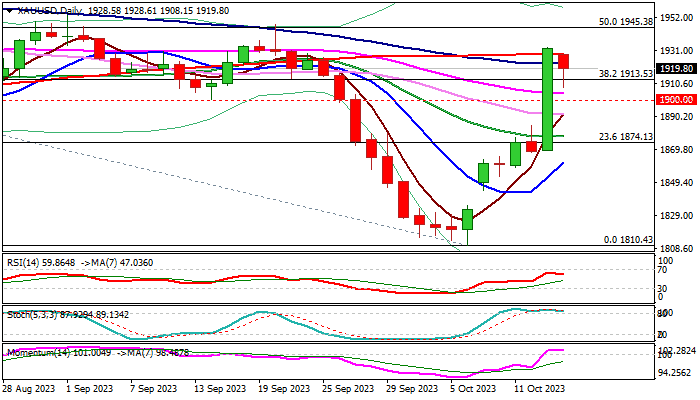

Technical picture on daily chart improved on the latest advance but overbought conditions prompted a partial profit-taking.

Weekly close well above pivotal Fibo barrier at $1913 (38.2% retracement of $2080/$1810 downtrend) and completion of reversal pattern on weekly chart contributed to bullish signals, adding to prospects for further advance).

Corrective dips should provide better levels to re-enter long positions while holding above $1913/00 zone (Fibo 38.2% / psychological).

Firm break of cracked 200DMA ($1929) and daily cloud top ($1936) open way for test of $1945/ 52 (50% retracement / Sep 1 spike high), guarding $1977 (Fibo 61.8%).

Res: 1929; 1936; 1945; 1952

Sup: 1913; 1908; 1900; 1890