Cable rises on better than expected UK PMI data

Bulls regained control on Thursday after better than expected UK PMI data (services and composite rose above 50 threshold which divides contraction from growth and manufacturing sector performed better than expected) brightened the outlook and gave fresh boost to sterling.

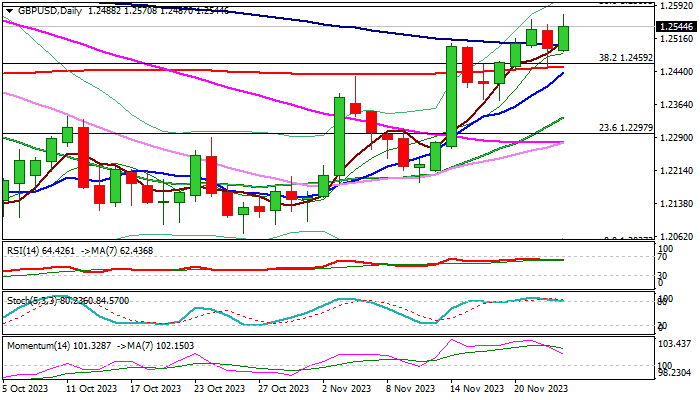

The pair hit new highest level in over two months though still holding within a consolidation range which extends into third consecutive day.

Solid data add to signals that economic activity might be accelerating and reducing bets for rate cuts next year, as inflation is still elevated and around 2 ½ times above the target, despite significant drop in Oct.

This suggests that rates need to remain high for some time in order to push inflation back to BoE’s 2% target, which will be supportive for pound.

Wednesday’s candlestick with long tail, posted after strong downside rejection at 200DMA, adds to positive signals, which look for confirmation on close above 100DMA (1.2500) to open way for fresh acceleration through pivotal Fibo barrier at 1.2589 (50% retracement of 1.3141/1.2037 downtrend).

Near-term action is expected to remain biased higher while holding above 1.2459/51 (broken Fibo 38.2% / 200DMA).

Res: 1.2570; 1.2589; 1.2642; 1.2719

Sup: 1.2500; 1.2459; 1.2451; 1.2428