Dollar index – bears pause ahead of US inflation data

The dollar index is moving in a narrow range in early Thursday, as holiday-thinned conditions slow the action and markets await key event for the dollar this week – release of US inflation data (PCE index) on Friday.

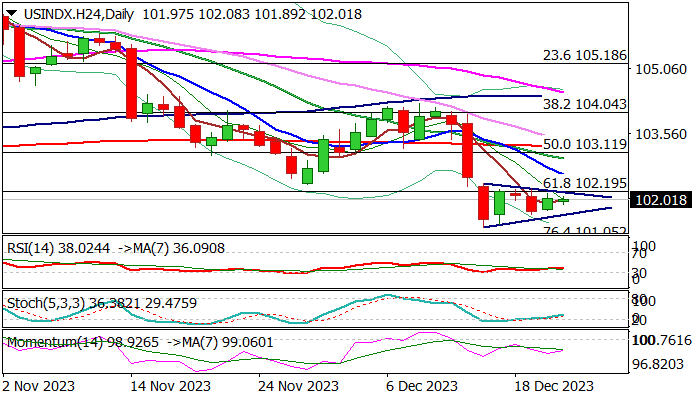

Near-term action is holding within narrowing consolidation, shaped in a triangle and awaiting fresh direction signals.

Technical studies are bearish on daily chart (negative momentum / MA’s in full bearish setup) pointing to a likely continuation of larger downtrend after a pause, as current consolidation remains capped by broken Fibo support at 102.19, reverted to solid resistance.

The dollar is also pressured by expectations of Fed rate cuts and expectations for the US central bank’s policy easing by 150 basis points in 2024.

Immediate bearish bias to remain intact under 102.19 Fibo barrier and extended upticks to be capped by falling 10DMA (102.60) with weekly close below 102.19 to add to bearish signals.

Res: 102.19; 102.36; 102.60; 102.97

Sup: 101.67; 101.37; 101.05; 100.30