Euro extends post-NFP fall on French snap election news

The Euro opened with gap-lower on Monday and fell to one month low, in extension of Friday’s 0.8% fall (the biggest one-day loss since Apr 12).

The single currency was deflated by much higher than expected US nonfarm payrolls, which boosted expectations that the Fed may keep rates unchanged for extended period (FOMC meets this week, with most of economists expecting the first rate cut in November) and lifted the dollar.

Surprise results of election for EU parliament and decision of French President Macron to call a snap parliamentary election increased pressure on Euro in early Monday trading.

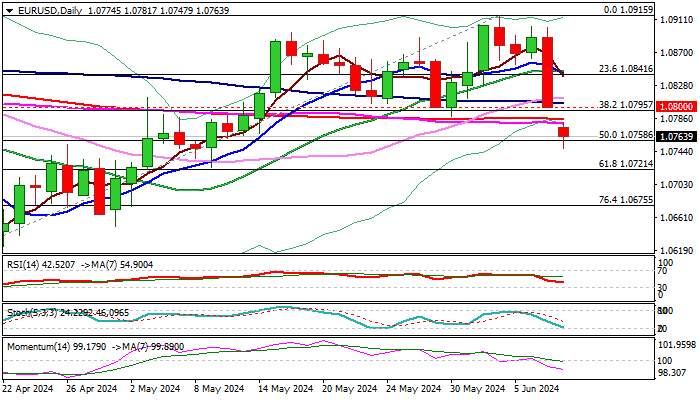

Technical picture weakened significantly on daily chart, as loss of pivotal 1.0800/1.0790 support zone (psychological / Fibo 38.2% of 1.0601/1.0915 / daily cloud top / former higher low of May 30) completed a failure swing pattern on daily chart and generated negative signal.

Daily MA turned to bearish setup and strengthening negative momentum add to near-term bearish outlook, as Monday’s drop cracked 50% retracement of 1.0601/1.0915 uptrend, with clear break here to open way for a drop below 1.0700 mark.

Meanwhile, partial profit taking after sharp fall cannot be ruled out, with 1.0800/20 zone (now reverted to solid barriers) expected to ideally cap upticks and offer better levels to re-enter bearish market.

Res: 1.0785; 1.0820; 1.0841; 1.0889

Sup: 1.0747; 1.0721; 1.0700; 1.0675