Risk aversion lifts the dollar

The dollar index extends recovery into second straight day, with strong bounce from new four-month low (103.31) on Thursday, being fueled by fresh risk aversion on global cyber outage, which hit financial centers, banks, airlines and many others, prompting investors into safer assets.

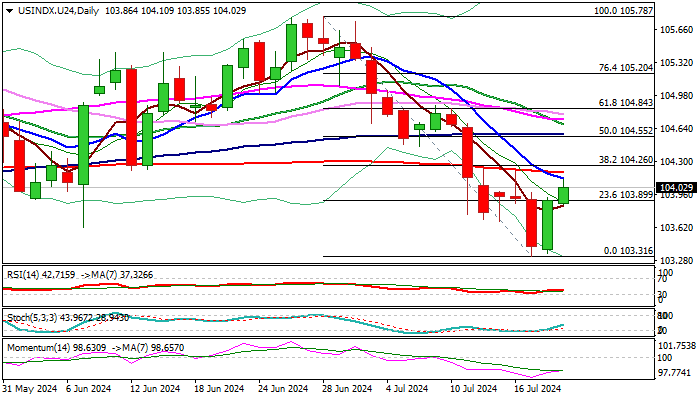

Technical picture on daily chart is overall still negative, as 14-d momentum remains deeply in the negative zone and MA’s are in bearish configuration, warning that recovery may struggle to sustain gains.

Bulls face headwinds on approach to falling 10DMA (104.12), which recently formed a death cross with 200DMA (104.18), guarding pivotal Fibo barrier at 104.26 (38.2% of 105.78/103.31 bear-leg)., with sustained break through this zone needed to improve near-term outlook for further recovery.

Otherwise, the downside is expected to remain vulnerable, with limited recovery to offer better levels to re-enter larger downtrend.

Res: 104.18; 104.26; 104.55; 104.67

Sup: 103.85; 103.67; 103.31; 103.00