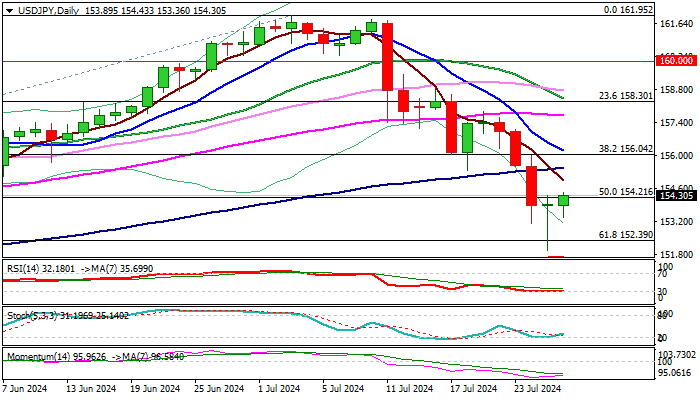

USDJPY – upticks under daily cloud base to mark positioning for fresh push lower

USDJPY keeps slight bullish bias on Friday and attempting to generate initial reversal signal, after larger bears stalled on Thursday and left long-tailed Doji on bounce from new multi-week low, which also formed a bear-trap on daily chart (below 152.39 Fibo support).

The downtrend from new multi-decade high (161.95) is taking a breather, with stronger bounce seen unlikely, as yen has strengthened significantly from Japan’s recent interventions and keeps momentum.

Growing expectations that the Fed is on track to start easing its monetary policy, as early as September and to deliver three rate cuts in 2024, continue to weigh on dollar, while yen received additional support from fresh talks that BoJ may continue to hike interest rate.

The pair may extend losses towards 150 support in such scenario, with limited corrections to provide better selling levels, as daily studies remain in firm bearish setup

Cracked Fibo support at 152.39 (61.8% retracement of 146.48/161.95) marks initial target, followed by 200DMA (151.63), violation of which to open way towards 150 zone.

Recovery should stay capped under 156 resistance zone (base of thickening daily cloud / falling 10DMA / broken Fibo 38.2%) to keep bears in play.

Res: 154.93; 155.50; 155.70; 156.00

Sup: 153.10; 152.39; 151.94; 151.63