EURUSD continues to move within extended consolidation range, but larger bears hold grip

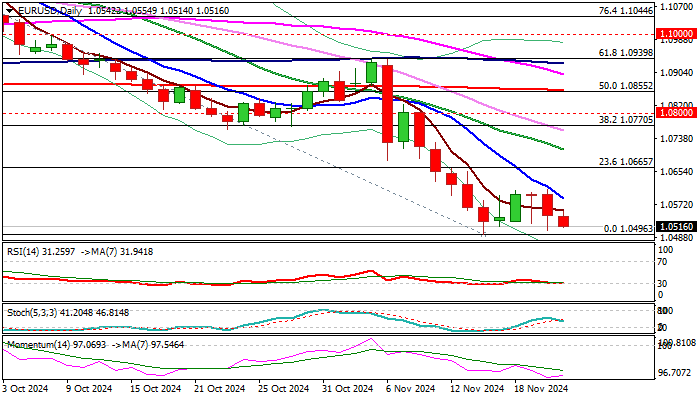

EURUSD remains biased lower as near term action stays within extended consolidation range above 13-month low (1.0495), with the upside being capped by solid barriers at 1.0600 zone (former low of Apr 16 / Fibo 23.6% of 1.0936/1.0495 / falling 10 DMA).

Negative 14-d momentum and daily MA’s in full bearish setup support scenario, with selling opportunities expected as long as upticks remain capped at 1.0600 zone.

Firm break of 1.0495 pivots to expose targets at 1.0448 (3 Oct 2023 low) and 1.0405 (50% retracement of 0.9535/1.1275).

Alternatively, violation of 1.0600 pivots would ease downside pressure, but sustained break above double-Fibo barrier at 1.0665 (23.6% of 1.1214/1.0495 / 38.2% of 1.0936/1.0495) will be needed to validate initial bullish signal.

Fundamentals remain overall negative for Euro, as Trump trades continue to inflate dollar and geopolitical uncertainty weigh strongly on risk mode.

Market focus shifts on Friday’s release of Eurozone PMI data (Manufacturing Nov 46.0 f/c and Services Nov 51.6 f/c, both indicators expected to remain unchanged from previous month), with divergence of Nov numbers from consensus to generate fresh direction signal.

Res: 1.0557; 1.0600; 1.0665; 1.0700

Sup: 1.0495; 1.0448; 1.0405; 1.0290