Weak economic data pushed euro to the lowest levels in two years

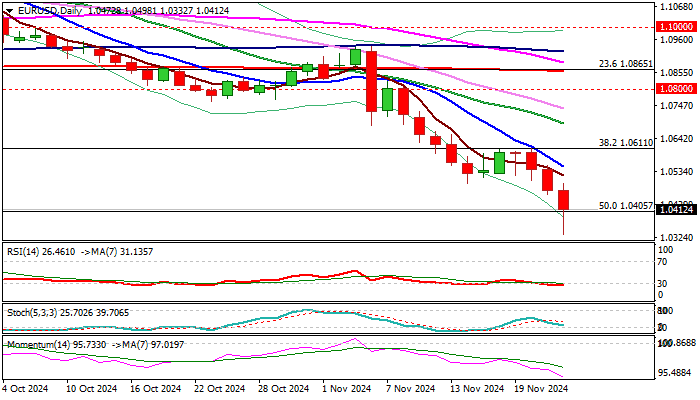

EURUSD spiked to two-year low on Friday following weaker than expected data from Germany Q3 GDP / Nov PMI) and Eurozone (Nov PMI) which further soured already weak sentiment.

The single currency remains pressured by strong dollar on post-US election euphoria, as well as safe-haven demand and is on track to end the third consecutive week with significant losses.

Also, November’s drop is the biggest monthly loss since Apr 2022, with the pair being on track for the second monthly close in red.

On the other hand, today’s quick bounce from new low and formation of a long tail on daily candle, warns of fresh bids and potential bear-trap formation (under 50% retracement of 0.9535/1.1275, 2022/23 uptrend).

This may, along with overstretched daily indicators and Friday’s profit-taking, keep bears on hold for consolidation, although with limited potential for stronger upside action, due to persisting strong bearish pressure in past couple of weeks.

Limited upticks should be capped under solid 1.0500/50 resistance zone to keep larger bears intact.

Only acceleration through 1.0600/10 pivotal barriers (broken Fibo / former lower platform) would sideline bears.

Res: 1.0448; 1.0496; 1.0552; 1.0611

Sup: 1.0332; 1.0290; 1.0222; 1.0200