WTI oil – look for direction signal on breach of $68.00 or $70 triggers

WTI oil price rose over 1% on Monday after better than expected China’s manufacturing data boosted positive sentiment, while fresh concerns about the Middle East ceasefire collapse, add support.

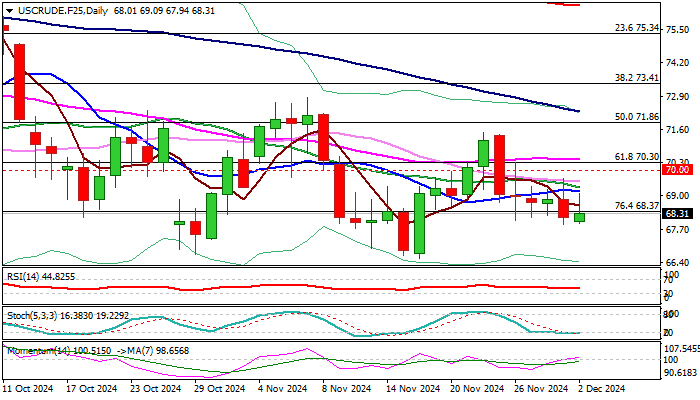

Fresh gains peaked above $69.00 mark but were so far unable to hold gains, as Friday’s bearish candle with long upper shadow, points to solid offers.

Oil price remains below psychological $70 level for the sixth consecutive day and also hold below converged daily Tenkan/Kijun-sen ($69.69), with near-term action being also weighed by last Monday’s large bearish candle (oil price was down 3.25% in the biggest daily fall since Oct 14).

On the other hand, bears have so far found a temporary footstep at $68.00 zone that keeps near-term action within a range.

Technical studies are mixed on daily chart as 14-momentum is neutral, MA’s in bearish configuration and stochastic is oversold.

Look for direction signals on break of either $68.00 or $70 triggers.

Res: 69.33; 70.00; 70.30; 71.00

Sup: 68.00; 66.93; 66.33; 65.26