Australian Dollar falls to 4-month low on weaker than expected GDP data

AUDUSD fell 1% to four-month low on Wednesday, after weaker than expected Australia’s Q3 GDP data, deflated RBA’s hawkish stance.

Significantly weaker than expected economic growth in the third quarter and holding well below RBA’s projections, further fuel signals for rate cut, with bets for easing policy being almost doubled after today’s release.

Fresh political instability in Asia and persisting growth concerns added pressure on Aussie dollar.

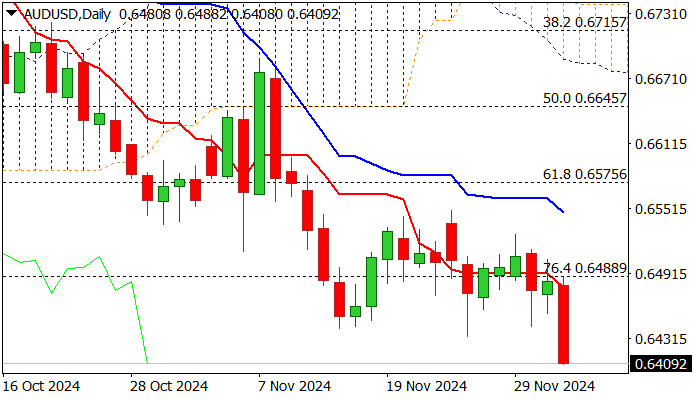

Technical picture remains bearish on daily chart, as negative momentum strengthens, and the price dipped below falling and diverging daily Tenkan/Kijun-sen.

The pair is holding firmly in red for the third consecutive month that also contributes to negative outlook, with some profit-taking (probably limited) to be anticipated in the near future.

Bears pressure round-figure 0.6400 support and eye targets at 0.6362 (Apr 19 low) and 0.6348 (2024 low posted on Aug 5).

Former lows at 0.6440 zone offer immediate resistance, followed by broken Fibo 76.4%, reinforced by falling 10DMA (0.6489) and Nov 29 lower top (0.6528).

Res: 0.6537; 0.6575; 0.6600; 0.6637

Sup: 0.6400; 0.6362; 0.6348; 0.6270