Absence of Brexit news maintains directionless mode; key UK data in focus for fresh signals

Cable ticked higher on Monday but remains directionless and in range trading that extends into sixth straight day.

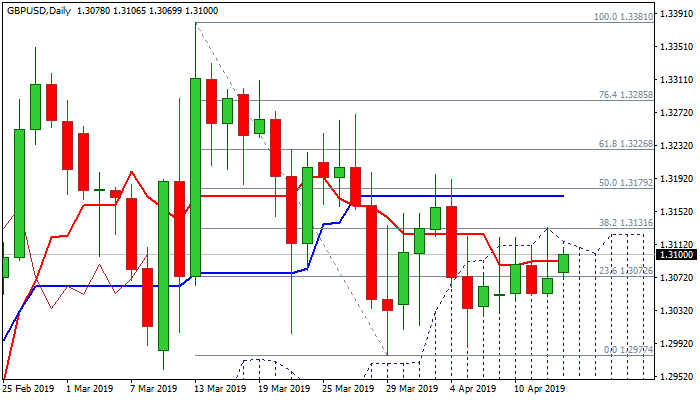

Near-term action remains capped by daily cloud top (1.3115) which marks key resistance along with Fibo barrier at 1.3131 (38.2% of 1.3381/1.2977).

Flat daily indicators add to neutral mode, but absence of news from Brexit is the main obstacle.

Releases of Key UK data are in focus this week with jobs/earnings data are due tomorrow; inflation on Wednesday and retail sales on Thursday.

Data could generate fresh direction signals in holiday-shortened week with lower volumes.

Sustained break above cloud top / Fibo barrier would generate bullish signal for recovery extension towards targets at 1.3179/96 (50% retracement / 3 Apr high), while close below 1.3030/40 zone (base of recent range) would weaken near-term structure and expose key support at 1.2974 (200SMA).

Res: 1.3115; 1.3131; 1.3179; 1.3196

Sup: 1.3069; 1.3042; 1.3030; 1.2974