Deeper pullback cannot be ruled out on bulls’ stall / profit-taking

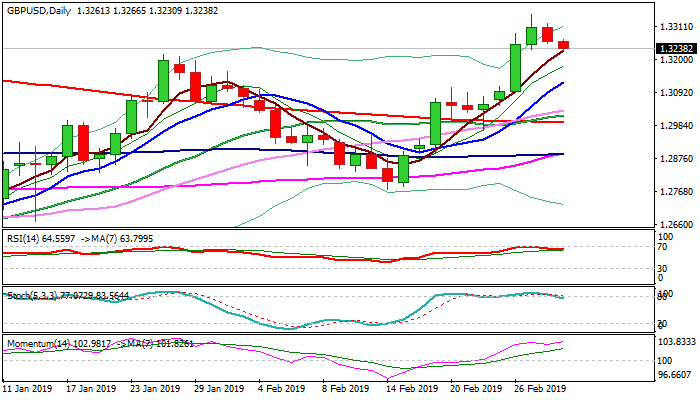

Cable holds in red for the second day and tested initial support at 1.3230 (rising 5SMA) on Friday.

Profit-taking after strong rally this week could push sterling lower, as slow stochastic reverses from overbought territory and supports scenario.

Pound was boosted strongly by reduced fears about no-deal Brexit last week, but the optimism starts to fade, as there are no further changes in Brexit process, except that UK’s exit from the Union could be delayed, but this seems to be already priced in.

Corrective action looks more likely after bulls failed in penetration of thick falling weekly cloud, with Friday’s close below cloud, to generate further bearish signal.

However, the pair still holds strong bullish momentum that could limit dips, as there are a plenty of space towards key support at 1.3129 (rising 10SMA / Fibo 38.2% of 1.2772/1.3349 rally), violation of which is needed to generate reversal signal.

Res: 1.3266; 1.3319; 1.3349; 1.3386

Sup: 1.3230; 1.3213; 1.3160; 1.3129