Cable bounces after solid data / hawkish BoE

Cable bounces from new multi-month low on Tuesday, boosted by better than expected UK services PMI data and hawkish stance from BoE policymakers, who signaled that rate cut might be delayed, as the central bank sees too early cut more harmful than to start easing policy too late.

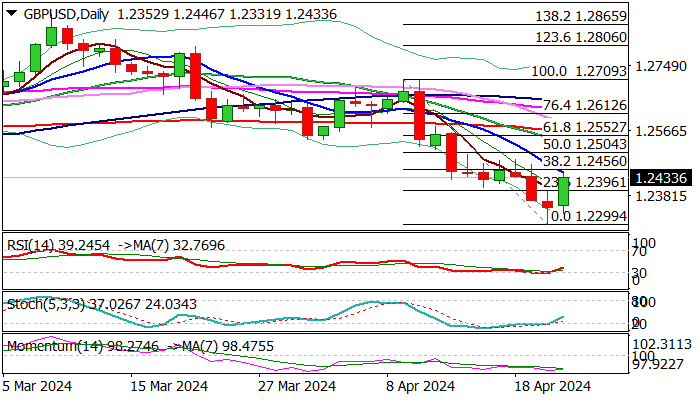

Brightened near-term outlook so far lifted the price above initial barrier at 1.2400, with pivotal 1.2446/56 resistance zone (falling 10DMA / Fibo 38.2% of 1.2709/1.2299) being under increased pressure.

Close above these levels is needed to generate initial reversal signal and open way for further recovery towards next targets at 1.2500/60 zone (round-figure / Fibo 61.8% / 200DMA).

Daily studies are still in predominantly bearish setup and warn of limited correction before larger bears regain control, with sustained break of 200DMA seen as a game changer.

Res: 1.2446; 1.2504; 1.2536; 1.2565

Sup: 1.2396; 1.2331; 1.2299; 1.2210