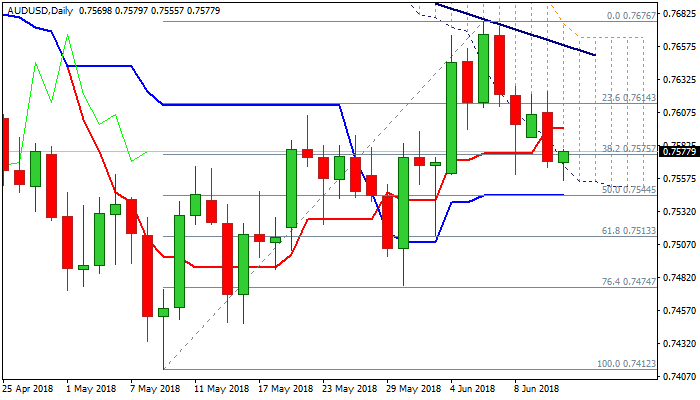

AUDUSD – bearish bias below daily cloud

The Aussie dollar edged higher on Wednesday after extension of four-day descend found footstep at 0.7553 (30SMA) and profit-taking on Tuesday’s 0.5% fall pushed the price higher.

Near-term action holds in a downtrend from 0.7676/73 double-top and remains pressured by descending thick daily cloud.

Repeated closes below daily cloud maintain negative near-term tone off 0.7676, as pullback reversed over 38.2% of 0.7412/0.7676 rally so far.

Bearishly aligned daily techs support the notion, with eventual break below 30SMA expected to open next pivotal support at 0.7513 (Fibo 61.8%).

Fed’s rate decision announcement is due later today and may cause increased volatility.

Meanwhile, the pair is expected to hold within narrow range.

Sideways-moving daily Tenkan-sen marks solid resistance at 0.7595, which should keep the upside protected and maintain bearish bias0.7412 low last week.

Bearish scenario requires close below cloud to shift focus lower.

Res: 0.7579; 0.7595; 0.7623; 0.7657

Sup: 0.7555; 0.7544; 0.7513; 0.7474