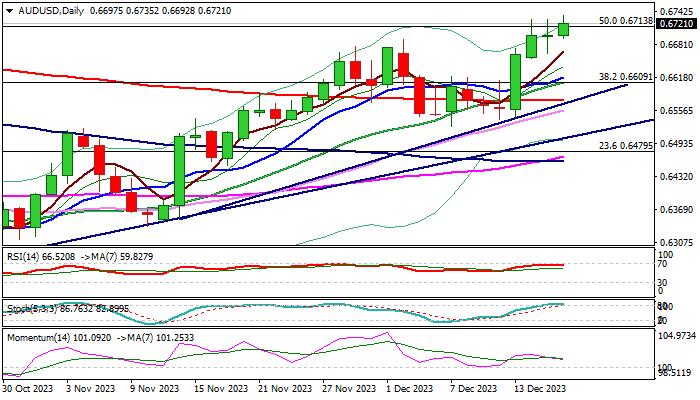

AUDUSD – bulls hold grip but risk of rally’s stall persists

Bulls regained traction after brief pause on Friday, shaped in a long-legged Doji candle and probe again through important Fibo barrier at 0.6713 (50% retracement of 0.7157/0.6270 downtrend).

Clear break of this level (reinforced by upper 20-d Bollinger band) is required to generate initial signal of bullish continuation and expose targets at 0.6800/18 (round-figure / Fibo 61.8%).

However, warning signals from fading bullish momentum and overbought stochastic on daily chart should not be ignored as long as price stays below the top of thin weekly cloud (0.6743), though more evidence will be needed to signal stall.

Friday’s low marks initial support at 0.6663, followed by 10DMA (0.6617) and lower pivots at 0.6582/76 (trendline support / 200DMA).

Res: 0.6735; 0.6800; 0.6818; 0.6846

Sup: 0.6692; 0.6663; 0.6617; 0.6576