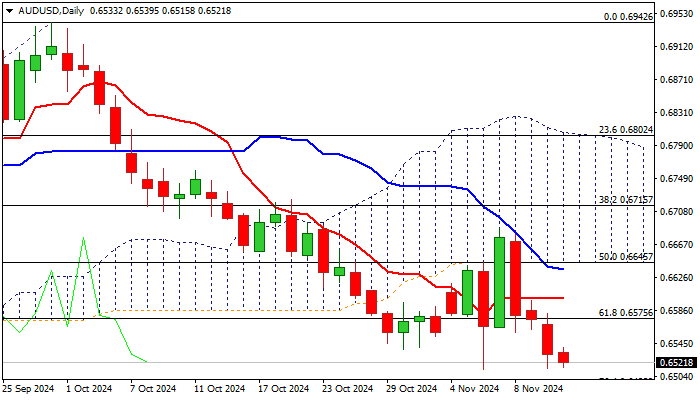

AUDUSD – consolidation above three-month low likely to precede fresh weakness, US CPI data in focus

AUDUSD remains in red for the fourth straight day, but bears slowed on Wednesday and action holding within a narrow range just above three-month low.

Technical studies remain bearish on daily chart and favor further downside, though oversold conditions suggest that consolidation is likely to precede.

Broken daily Tenkan-sen (0.6600) should cap upticks to marks positioning for fresh push lower and attack at 0.6488 Fibo support (76.4% of 0.6348/0.6942).

Only firm break of daily Kijun-sen / cloud base (0.6637/45 respectively) would sideline bears.

Fundamentals, however, are likely to be pair’s key driver today, with Australia’s wage growth slowing in Q3 to the lowest in almost two years, though the data are unlikely to have significant impact on RBA’s stance on interest rates.

Focus is on release of US CPI (Oct y/y 2.6% f/c vs Sep 2.4%; core Oct 3.3% f/c, unchanged from Sep), which will be key driver today and Australia’s Oct labor report (due early Thursday).

Res: 0.6537; 0.6575; 0.6600; 0.6637

Sup: 0.6512; 0.6488; 0.6400; 0.6348