AUDUSD erases overnight’s gains on risk aversion after China tariffs announcement

The Aussie dollar fell sharply to the session low at 0.7664 after China announced new tariffs on US good, sparking strong risk aversion in the markets.

Fresh weakness erased gains on upbeat Australian retail sales, when the pair spiked to one-week high at 0.7717, but gains were short-lived.

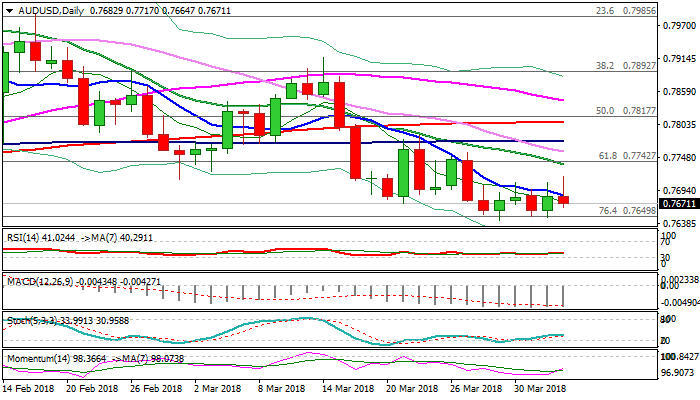

The price returned below 10SMA which capped the action in past five days and is back to week-long congestion after failure to break higher.

News further weakened the sentiment, with immediate risk turning lower again as daily techs are in full bearish setup.

Repeated close below 10 SMA would maintain bearish pressure and keep key n/t support at 0.7642 (29 Mar low) exposed.

Break here (also near Fibo 76.4% of 0.7500/0.8135 rally and weekly 100SMA) would open way towards key med-term support at 0.7500 (11 Dec low).

Res: 0.7685; 0.7717; 0.7738; 0.7759

Sup: 0.7664; 0.7642; 0.7631; 0.7600