AUDUSD extends recovery but strong US inflation numbers could limit rally

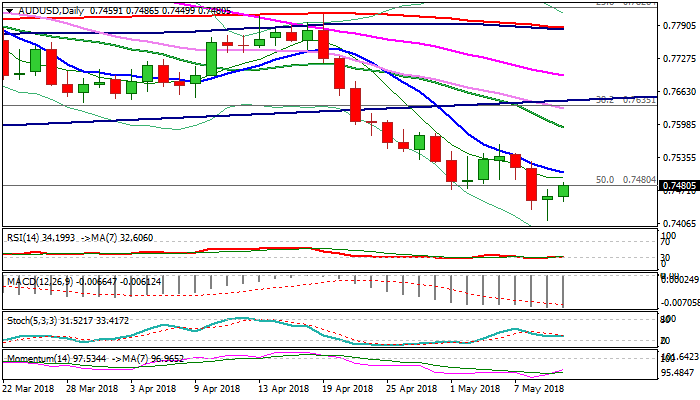

The Aussie dollar extends bounce from 11-month low at 0.7412 on Thursday, following strong downside rejection previous day, which left long-tailed Doji candle.

Fresh recovery hit session high at 0.7486 so far and generates initial bullish signal as reversal pattern is forming on daily chart.

North-heading 14-d momentum and daily RSI emerging from oversold territory are positive signals, but conflicting with falling MA’s in firm bearish setup.

Close above 10SMA (0.7506) would provide additional bullish signal and sideline existing downside risk for stronger corrective action.

US inflation data are key, as upbeat results would boost the US dollar and neutralize current positive signals, for fresh extension of bear-leg from 0.7812 (19 Apr lower top).

Res: 0.7486; 0.7506; 0.7527; 0.7560

Sup: 0.7450; 0.7412; 0.7370; 0.7321