AUDUSD – hawkish RBA and dovish BOJ underpin recovery but caution on still weak technical studies

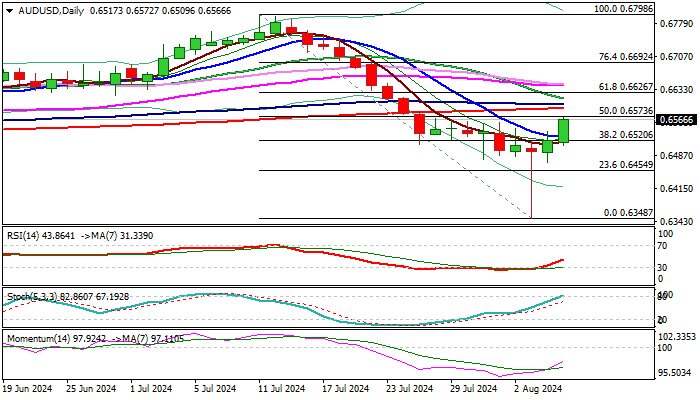

AUDUSD recovery from Monday’s spike low (0.6348, the lowest since early Nov 2023) picks up on Wednesday.

Hawkish RBA on Tuesday, with policy diverging from other major central banks, fading fears about US recession and the latest dovish shift from BOJ, were the key positive factors for Aussie dollar.

Fresh acceleration higher (the pair was up 0.85% during Asian / early European trading on Wednesday) cracked pivotal barriers at 0.6560/70 zone (daily Kijun-sen / 50% retracement of 0.6798/0.6348 descent / the base of rising thick daily cloud).

Firm break here to add to bullish signals and expose next strong obstacles at 0.6590/0.6600 (converging 200/100DMA’s), close above which to further strengthen near-term structure and open way for stronger recovery

However, caution is still required as thick daily cloud weighs, north-heading 14-d momentum is still deeply in negative zone and stochastic penetrating overbought territory.

Daily close above 0.6520/10 zone to main term bias.

Res: 0.6573; 0.6590; 0.6601; 0.6626

Sup: 0.6530; 0.6510; 0.6472; 0.6455