AUDUSD – hawkish RBA and Fed expected to stay on hold continue to fuel bulls

Australian dollar continues to trend higher vs its US counterpart and hit five-week high and hit five-week high in European trading on Monday.

The Aussie remains underpinned by the latest RBA action, after the central bank surprised by 25 basis points rate hike and signals of further tightening, as inflation remains elevated despite strong measures.

On the other hand, the US Federal Reserve meets this week and is widely expected to keep interest rate on hold for the first time in over one year.

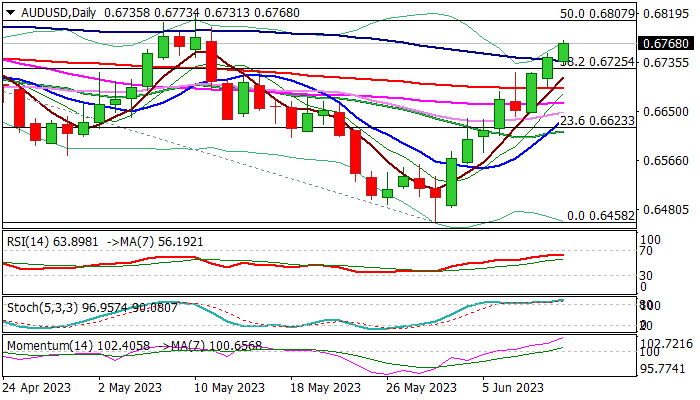

Near-term uptrend from 0.6458 (2023 low, posted on May 31) remains intact on daily chart, as fresh bullish signal was generated on Friday’s close above 0.6725/37 pivots (Fibo 38.2% of 0.0.7157/0.6458 / 100DMA), the last obstacle en-route towards key resistances at 0.6807/18 (50% retracement of 0.71570.6458 / May 10 high).

Firm break here would signal bullish continuation and expose targets at 0.6890/0.6915 (Fibo 61.8% / weekly cloud top).

Caution on strongly overbought stochastic on daily chart which signals that bulls may face headwinds in coming sessions.

Broken 100DMA / Fibo 38.2% (0.6737/25) reverted to solid supports which should keep the downside protected.

Res: 0.6818; 0.6864; 0.6890; 0.6915

Sup: 0.6725; 0.6689; 0.6666; 0.6635