AUDUSD is on track for the biggest weekly drop since mid-April

Australian dollar continues to trend lower vs its US counterpart for the fifth consecutive day, on track for the biggest weekly loss since the second week of April.

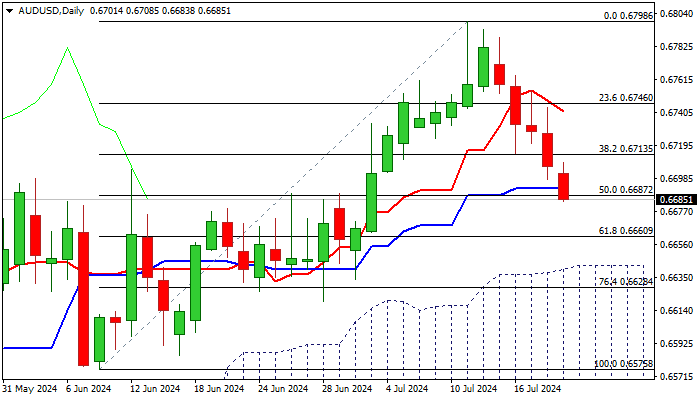

Bears have so far retraced 50% of 0.6575/0.6798 upleg and look for daily close below daily Kijun-sen (0.6691), to reinforce bearish signal.

Daily studies are weakening (fading bullish momentum / price fell below 10/20DMA’s) however, more work to the downside will be required to signal that bears are taking control and validate reversal signal, developing on weekly chart.

Further acceleration lower would look for test of 0.6660 (Fibo 61.8%) and 0.6642 (daily cloud top), while extended upticks should stay below broken Fibo 38.2% level, now acting as solid resistance (0.6713) to keep bears in play.

Res: 0.6700; 0.6713; 0.6741; 0.6764

Sup: 0.6662; 0.6631; 0.6604; 0.6575