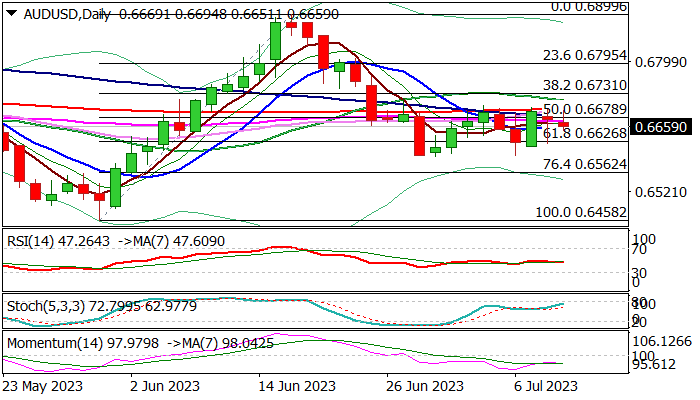

AUDUSD – multiple upside rejections at 200DMA keep the downside at risk

Australian dollar edged lower on Tuesday, pushing towards the mid-point of near-term range (0.6595/0.6705) after 200DMA (0.6697) again capped upside attempts, fueled by improved Australian Jun consumer sentiment and business confidence data.

Strong offers at 0.6700 zone keep the Aussie dollar pressured and define near-term consolidation range, with bearish technical picture on daily chart keeping the downside at risk for now.

Decline of 14-d momentum deeper into negative territory, adds to bearish near-term outlook, though scenario still looks for confirmation on penetration of daily cloud (cloud top lays at 0.6638) to open way for attack at range base (0.6595) and signal continuation of larger downtrend from 0.6899 (June 16 peak) on firm break lower.

Only sustained break above 200DMA would sideline larger bears and possibly allow for stronger recovery.

Res: 0.6678; 0.6697; 0.6711; 0.6747

Sup: 0.6650; 0.6626; 0.6595; 0.6562