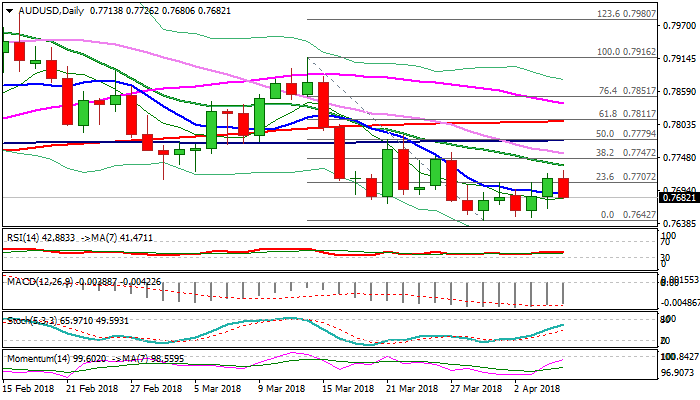

AUDUSD – negative outlook below key barriers at 0.7735/47

The Aussie dollar remains offered on Thursday and probes back below 10SMA (0.7688), as the greenback regains traction on reduced trade war fears.

The pair failed to sustain recovery after Wednesday’s dip and subsequent bounce, which resulted in eventual close above 10SMA and posting marginally higher high at 0.7726 today.

As mentioned in my previous reports, bearish configuration of daily studies maintains pressure and suggests limited recovery actions (helped by strengthening momentum) which should be ideally capped under falling 20SMA (currently at 0.7735) and Fibo 38.2% of 0.7916 / 0.7463 descend (0.7747) to keep overall bearish structure intact.

Firm break below 10SMA sees minor obstacles on the way to key supports at 0.7642/31 (29 Mar low / weekly cloud base / weekly 100SMA) break of which would be strong bearish signal.

Plethora of MA barriers which lies above our key 0.7735/47 barriers, heavily weighs and may provide strong headwinds for recovery attempts in alternative scenario on break above 0.7735/47.

Res: 0.7735; 0.7747; 0.7777; 0.7809

Sup: 0.7672; 0.7642; 0.7631; 0.7600