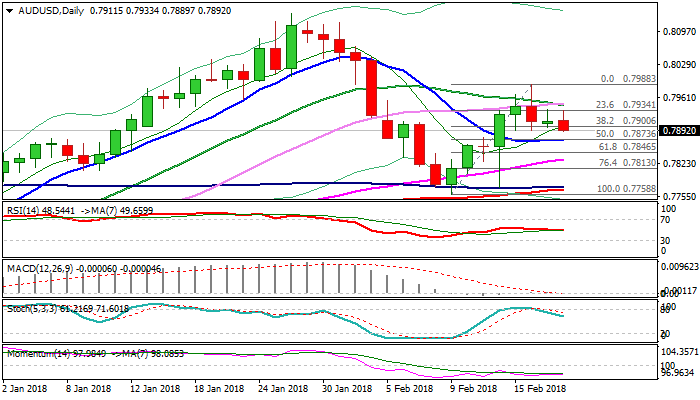

AUDUSD – stronger direction signals on break below 10SMA (0.7871) or above 0.80 zone

The Australian dollar stands at the back foot on Tuesday and probes below 0.79 handle, signaling extension of pullback from Friday’s high and strong upside rejection at 0.7988, where recovery rally stalled just ahead of 0.7991 Fibo barrier (Fibo 61.8% of 0.8135/0.7758 pullback).

Mixed setup of daily MA’s; neutral RSI/MACD and negative momentum show no clear near-term direction, with stronger bearish signals expected on violation of 10SMA (0.7871), or bullish on firm break above 0.7991 Fibo barrier.

Negative scenario would look for extension towards 0.7846 (Fibo 61.8% of 0.7758/0.7988 upleg) and 0.7832 (rising 55SMA) which would expose key supports at 0.7773/68 (converged 100/200SMA’s) and 0.7758 (09 Feb correction low).

Bullish scenario requires sustained break above 0.80 zone to open way for further recovery towards 0.8046 (Fibo 76.4% of 0.8135/0.7758 downleg) and 0.8100 (round-figure barrier).

Res: 0.7935; 0.7947; 0.7988; 0.8046

Sup: 0.7873; 0.7846; 0.7832; 0.7800