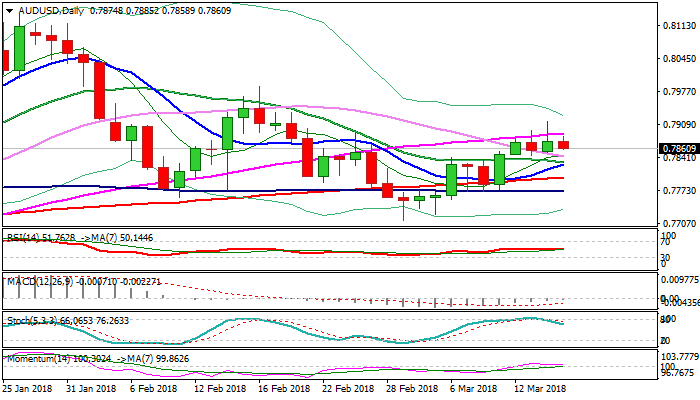

AUDUSD – stronger reversal signal on break below daily Kijun-sen

The Australian dollar moved lower on Thursday after repeated failure on attack at key barriers at 0.7882/90 (Fibo 61.8% of 0.7988/0.7712 / 55SMA).

Near-term action so far holds above daily Kijun-sen support (0.7850) which limits downside risk, generating after repeated upside rejections and supported by weakening momentum studies and south-heading slow stochastic which reversed from overbought territory.

Bearish scenario requires break below Kijun-sen as initial negative signal, with extension below daily cloud base (0.7817) to confirm top and reversal.

Extended consolidation could be expected while Kijun-sen holds, but close above 55SMA is needed to generate bullish signal for continuation of recovery leg from 0.7712 (01 Mar low).

Res: 0.7890; 0.7923; 0.7973; 0.7988

Sup: 0.7850; 0.7830; 0.7817; 0.7772