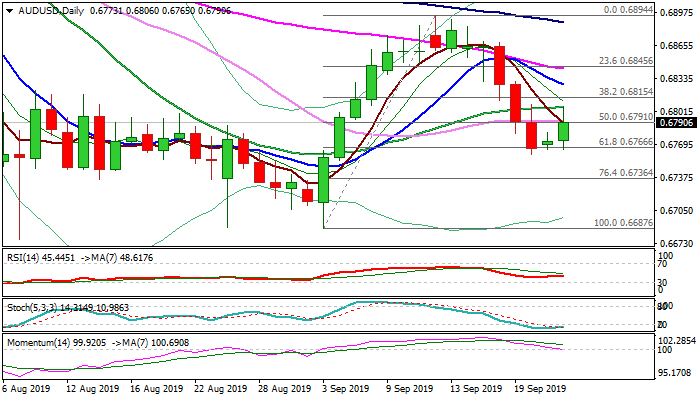

Aussie bounces from key Fibo support but remains biased lower on expectations for RBA rate cut

The pair jumped above 0.6800 handle on Tuesday as the Aussie was bought after slightly less dovish than expected comments from RBA governor Lowe, earlier today.

Bounce occurs after triple-failure at key Fibo support at 0.6766 (61.8% of 0.6687/0.6894) and generates initial signs of reversal, but still long way ahead to confirm scenario, as fresh bulls were so far capped by 20DMA (0.6806) and face strong obstacle at 0.6829 (base of daily cloud / 10DMA).

Lowe highlighted downside risk and said that further rate cuts may be needed, but policymakers need to check the evidence before making decision.

RBA board meeting is due next week and wide expectations are for 0.25% cut on Oct 1 policy meeting that will mark the third cut this year and bring interest rate to the new record low at 0.75%.

Current recovery might be a positioning for fresh weakness if RBA cuts again.

Firm break of 0.6766 Fibo support would open way towards key supports at 0.6687/77 (3 Sep / 7 Aug lows) and 0.6706 (2019 low, posted on 3 Jan).

Res: 0.6806; 0.6812; 0.6829; 0.6843

Sup: 0.6766; 0.6736; 0.6700; 0.6687