Aussie dollar came under additional pressure after China’s GDP fell below expectations

Australian dollar remains firmly in red for the second consecutive day and extends pullback from multi-week tops (0.6894).

Weaker than expected China’s GDP added pressure on Aussie dollar, as yuan and China stock prices fell after data.

Growing expectations of RBA rate hike pause further harm the sentiment and expected to additionally weigh on currency.

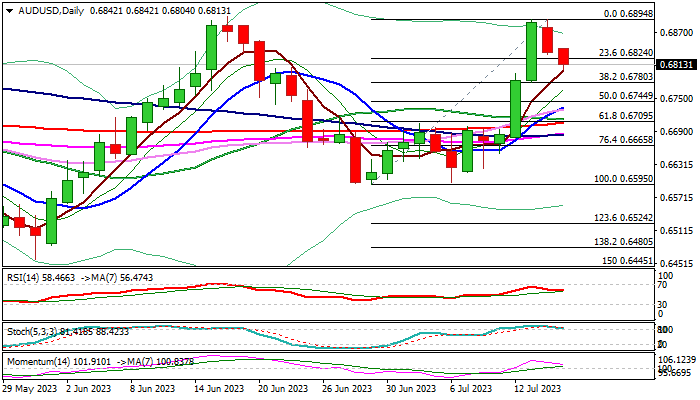

Reversal pattern is forming on daily chart, with initial signal expected on close below broken Fibo support at 0.6825 (23.6% retracement of 0.6598/0.6894 rally) and extension below 0.6781 (Fibo 38.2%) needed to confirm signal.

Fading bullish momentum and stochastic about to emerge from overbought zone on daily chart, contribute to negative signals, though overall picture is still bullish and warning that pullback might be a healthy correction, if pivotal support at 0.6780 stays intact.

Res: 0.6825; 0.6842; 0.6894; 0.6915

Sup: 0.6800; 0.6780; 0.6745; 0.6720