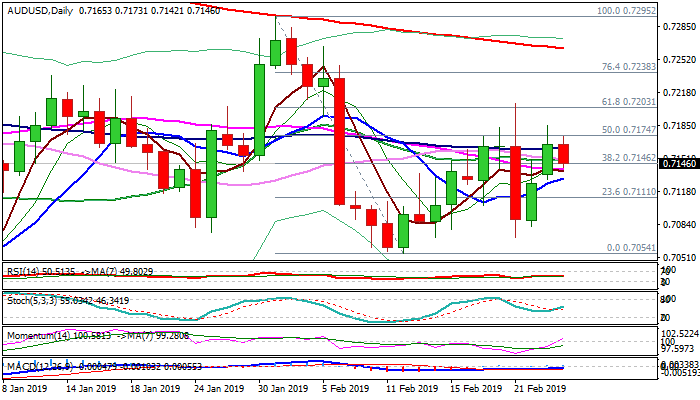

Aussie eases after another upside rejection; 10SMA marks key support

The Australian dollar eased from new recovery high at 0.7184 in early Tuesday’s trading, as risk appetite started to fade and bulls failed again to clearly break above pivotal 0.7174 barrier (50% retracement of 0.7295/0.7054 / daily Kijun-sen).

Easing on profit-taking after two-day rally so far looks as positioning for renewed attempts higher as bullish momentum continues to increase on daily chart and stochastic turned up and formed bull-cross.

Extended dips need to hold above rising 10SMA (0.7130) to keep alive hopes for fresh advance.

Conversely, return and close below 10SMA would weaken near-term structure and risk further easing.

Res: 0.7162; 0.7184; 0.7203; 0.7238

Sup: 0.7142; 0.7130; 0.7111; 0.7082