Aussie is consolidating after being hit by dovish RBA; all eyes now on Fed

The Australian dollar is consolidating in early Wednesday following 1.2% drop previous day after dovish stance from the Reserve Bank of Australia cooled expectations for earlier than expected rate hike.

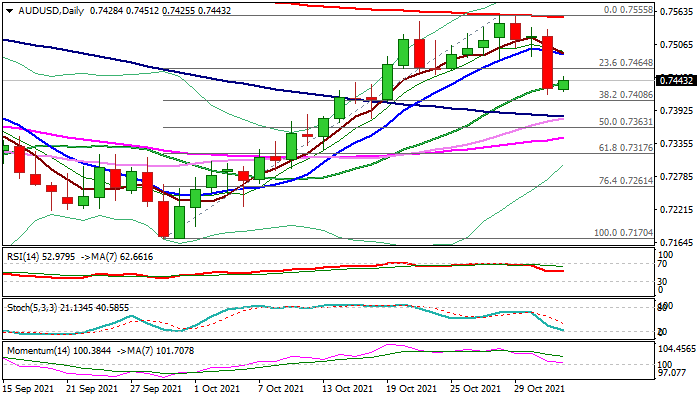

Tuesday’s fall marks the biggest one-day loss since May 12 and weighs on near-term structure, as reversal pattern has formed on daily chart, following a double rejection at 200DMA (0.7556) and subsequent weakness.

South-heading momentum is approaching the border of negative territory and 5/10DMA’s converged in attempt to form a bear-cross, generating negative signal, however, fresh bears need repeated close below 20DMA (0.7431) and break below Fibo pivot at 0.7408 (38.2% of 0.7170/0.7555) to confirm reversal and open way for further easing.

An end of Fed policy meeting and central bank’s decision, is the key event today and expected to spark fresh volatility in the markets.

Fed is expected to give the green light to reducing a massive bond purchases (about $120 billion a month), with increased expectations among investors that the central bank would signal earlier than expected rate hike, pressured by stubbornly high inflation.

Stronger than expected hawkish tones from Fed would give fresh boost to the US dollar and further deflate the Aussie.

Res: 0.7451; 0.7464; 0.7490; 0.7535

Sup: 0.7420; 0.7408; 0.7363; 0.7317