Dollar in a quiet mode but steady, ahead of Fed

The dollar remains steady against yen on Wednesday, although trading within a narrow range, partially due to closure of Tokyo and partially due to quiet mode ahead of Fed’s verdict later today.

The US central bank is widely expected to start unwinding its $120 billion worth pandemic stimulus, but markets will focus on Fed Chair Jerome Powell’s take on increased inflationary pressures.

Recent strong rise on anticipation of earlier than expected rate hike, pushed the US currency to the highest levels in four years against yen last month, but the greenback took a breather, awaiting for more signals.

Market analysts are divided on the impact of today’s Fed statement on the dollar, as tapering has been already priced in and some fear that the Fed would keep dovish stance, as many major central banks did, arguing that elevated inflation does not largely reflect transitory factors.

Also, Fed’s inflation assessment may point to more hawkish tilt, although this may not necessary mean higher interest rates soon, but rather still to be seen.

On the other side, stronger hawkish tones from Fed that would strengthen expectations for early tightening, as major world central banks await the Fed to make the first step, would provide fresh boost to the greenback.

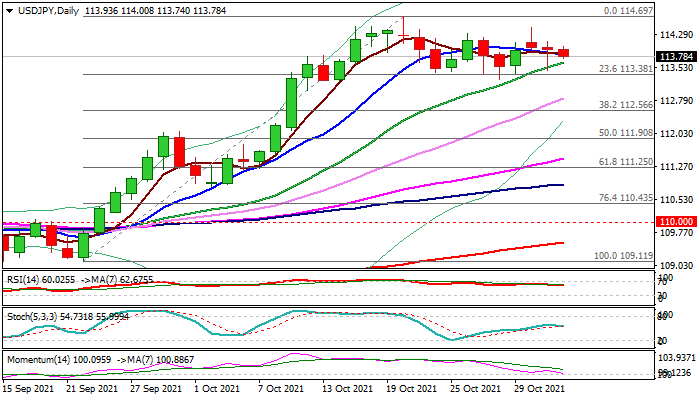

Important support for the USDJPY lays at 113.40 zone (Fibo 23.6% of 109.11/114.69) where the higher base is forming, and near-term bias is expected to remain firmly with bulls while the price action stays above this level.

Scenario of dovish Fed may deflate the greenback through 113.40 pivot and risk acceleration towards 112.56 (Fibo 38.2%) and 112.13 (monthly cloud top).

Conversely, more hawkish than expected stance of the US central bank may lift the dollar through key longer-term barriers at 114.60 zone and spark stronger bullish acceleration.

Res: 114.13; 114.44; 114.69; 115.00

Sup: 113.65; 113.40; 112.82; 112.56