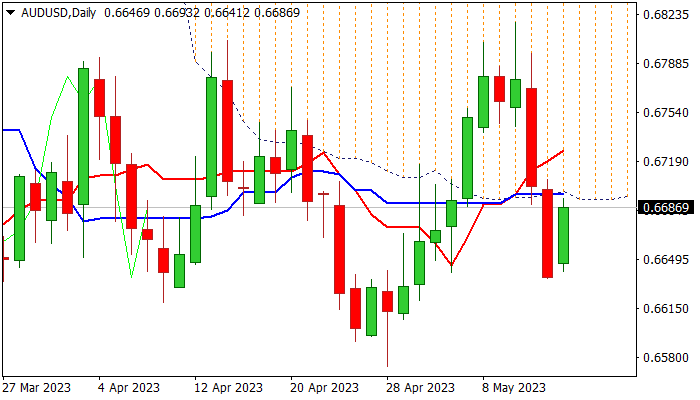

Aussie rebounds on improved risk sentiment but fresh bulls face headwinds from thick daily cloud

Australian dollar regained traction after nearly 2% drop last Thu/Fri and bounced 0.6% in Asian/European trading on Monday.

Fresh recovery was driven by improved risk sentiment, which prompted traders to collect some profits after a sharp two-day fall.

Prospects for stronger recovery are not very bright as positive momentum is conflicting with moving averages still in bearish setup on daily chart, with the base of thick daily cloud, reinforced by daily Kijun-sen (0.6692) and Fibo 38.2% of 0.6818/0.6636 (0.6705), marking strong obstacles which threaten to stall recovery.

Near-term picture is not very clear, with initial bullish signal expected on break into daily cloud, and likely acceleration towards next pivot at 0.6727 (daily Tenkan-sen), violation of which would add to reversal signals.

Caution on failure at cloud base, which will weaken near-term structure and keep the downside vulnerable.

A number of Fed’s policymakers are due to speak in the afternoon and may influence pair’s performance.

Res: 0.6692; 0.6727; 0.6748; 0.6775

Sup: 0.6631; 0.6607; 0.6573; 0.6563