Aussie rises to 10-week high as dollar sank after NFP miss

The Australian dollar extends advance in the fourth straight day on Monday and rose to the highest since Feb 26.

Extension of Friday’s post-NFP acceleration was boosted by weaker dollar over fading hopes that the US central bank would start tightening policy earlier than expected and higher prices of metals.

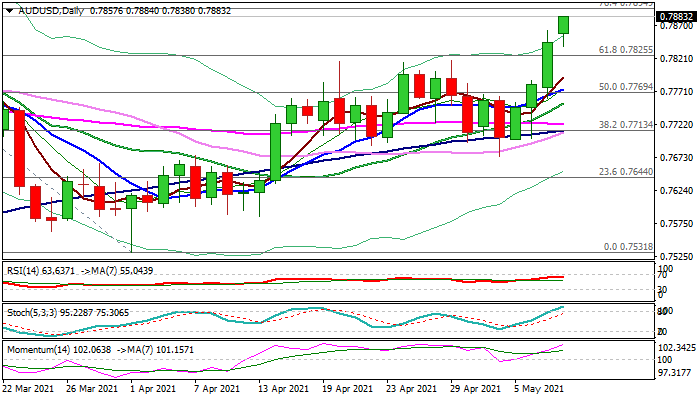

Bulls eye target at 0.7894 (Fibo 76.4% of 0.8007/0.7531) the last obstacle on the way towards key 0.8000 resistance zone which was briefly touched in February, for the first time in three years.

Friday’s close above pivotal Fibo barrier at 0.7825 (61.8% of 0.8007/0.7531) generated positive signal, with near-term action being supported by bullish daily studies.

Corrective dips are expected to provide better levels to re-enter bullish action, with solid supports at 0.7825/15 (broken Fibo barrier / late Apr higher platform) to ideally contain downticks.

Caution on extension below rising 10DMA (0.7774) that would put bulls on hold.

Res: 0.7894; 0.7923; 0.7956; 0.7973

Sup: 0.7849; 0.7825; 0.7815; 0.7774