Aussie stands at the back foot after weak CPI data; strong 0.7440 resistance zone continues to cap

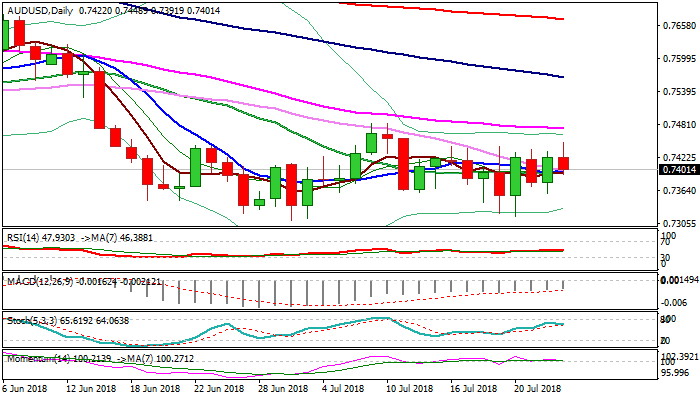

The Australian dollar dipped below 0.74 handle after another failure at strong 0.7440 zone, which marked the sixth consecutive upside rejection.

The pair briefly touched new two-week high at 0.7448, but gains were short-lived, confirming the strength of resistance.

Australian inflation data missed forecasts in Q2 (headline q/q CPI rose 0.4% vs 0.5% f/c, while annual figure was up 2.1% VS 2.2% f/c).

Subdued inflation suggests the RBA would stay on record low cash rate at 1.5% for the third straight year.

Policymakers expect inflation to rise gradually towards central bank’s 2-3% target, as weak labor sector is seen as one of main obstacles for economy growth.

The Aussie showed little benefit from bullish signal on Tuesday’s bullish outside day, remaining congested within 0.7360/0.7440 range for the third day, despite CPI data which were expected to be a catalyst.

Mixed signals from daily techs (cluster of converged daily MA’s still holds but momentum and slow stochastic are negatively aligned) lacks clearer direction signal for now

Res: 0.7404; 0.7431; 0.7448; 0.7474

Sup: 0.7391; 0.7359; 0.7343; 0.7317