Australian dollar falls further after weak labor data

AUDUSD remains in red for the second consecutive day, with overall negative Australian September labor data, adding to downside pressure on renewed risk aversion.

Employment rose less than expected and was well below previous month’s growth (Sep 6.7K vs 20K f/c and Aug 63.3K), contributing to negative impact, as unemployment ticked lower from 3.7% in Aug to 3.6% in Sep.

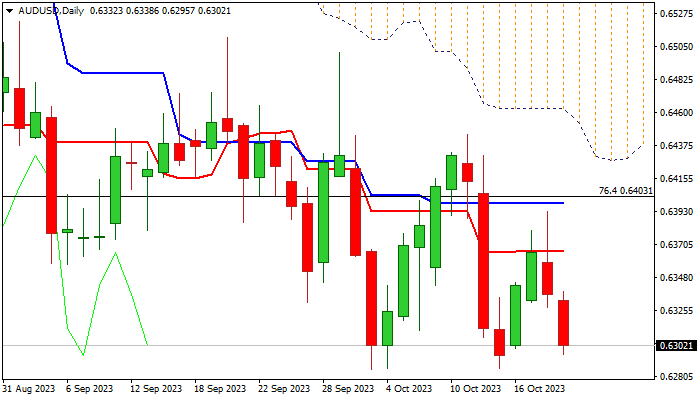

Limited recovery kept daily technical studies in full bearish mode, with fresh weakness increasing pressure on 2023 lows (0.6285/86 of Oct 3 / 13), break of which to signal continuation of larger downtrend and expose 2022 low (0.6170).

Near-term bias is expected to remain with bears while the action holds below daily Tenkan-sen (0.6365), while lift above daily Kijun-sen (0.6398) would sideline downside threats.

Res: 0.6338; 0.6365; 0.6398; 0.6452

Sup: 0.6285; 0.6272; 0.6200; 0.6170