Euro loses traction as deepening crisis and higher oil prices hurt risk sentiment

EURUSD came under pressure on Tuesday, as risk sentiment started to fade on deepening crisis in the Middle East.

Higher oil prices and growing fears that the situation could deteriorate after Iran for oil embargo on Israel, add pressure to the single currency, as such conditions would cause further negative impact on already fragile bloc’s economy.

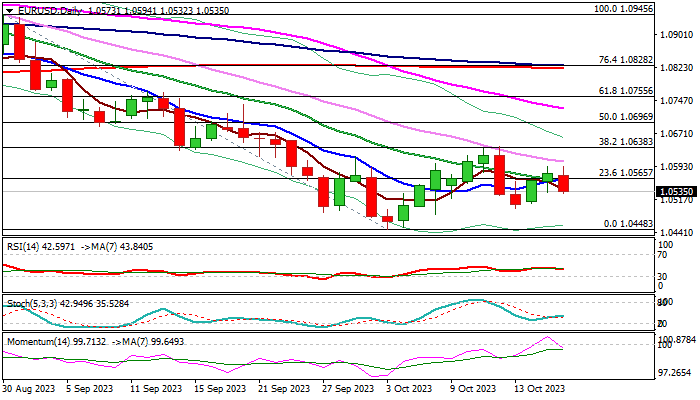

Technical picture on daily chart is weakening, with 14-d momentum indicator entering negative territory and price slid below daily Tenkan-sen / Kijun-sen, already in bearish configuration, while falling and thickening daily Ichimoku cloud maintains pressure.

Immediate risk is on retest of 1.0495 pivot (Oct 13 higher low), loss of which will complete a failure swing pattern on daily chart and signal an end of corrective phase from 1.0448 (2023 low, posted on Oct 10).

Converged 10/20DMA’s (1.0559) mark immediate and pivotal resistance and sustained break higher would ease immediate downside pressure, however, lift above 1.0638 (recovery top / Fibo 38.2% of 1.0945/1.0448 bear-leg) is needed to bring bulls fully in play.

Res: 1.0559; 1.0594; 1.0638; 1.0661

Sup: 1.0495; 1.0482; 1.0448; 1.0405