Bear take a breather after 4.5% fall; outlook remains negative

WTI oil price is holding within narrow consolidation on Thursday, following 4.5% fall on Wednesday on comments from President Trump who said the US refrains from further military action.

The sentiment was additionally weakened by unexpected rise in US crude stocks, helping fresh bears to register the biggest one day loss since 29 Nov.

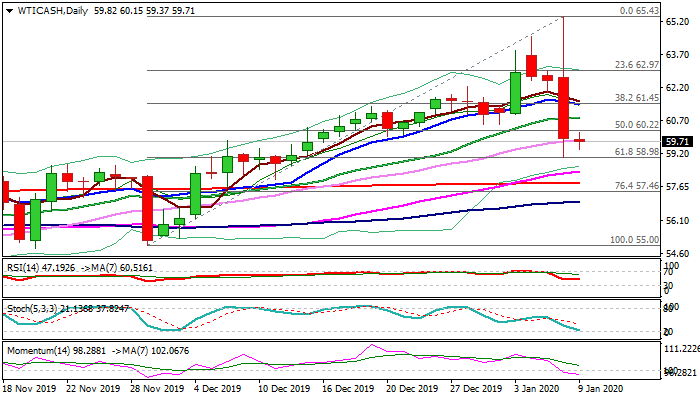

Wednesday’s large bearish candle with long upper shadow weighs on near-term action and signaling further weakness, as daily momentum broke into negative territory and continues to head south.

Bears found temporary footstep at $58.98 (Fibo 61.8% of $55.00/$65.43 upleg) with consolidation to ideally stay capped by broken 20DMA ($60.80) before bears resume.

Close below $58.98 pivot is needed for bearish signal for extension towards 200DMA ($57.81) and Fibo 76.4% ($57.46).

Res: 60.00; 60.22; 60.80; 61.45

Sup: 59.37; 58.98; 58.38; 57.81