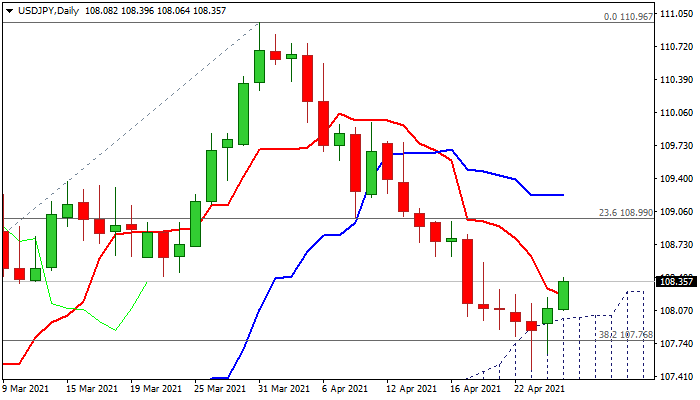

Bear-trap and rising thick daily cloud add to signs of downtrend stall

The dollar bounces in early Tuesday’s trading after double failure at key Fibo support at 107.76 (38.2% of 102.59/110.96) signaled formation of bear-trap pattern and generated initial bullish signal.

The action is also supported by rising daily cloud as dips repeatedly failed to register daily close within the cloud.

On the other side, momentum remains in the negative territory and conflicts positive signals, keeping the downside vulnerable

Fresh recovery cracked initial Fibo barrier at 108.30 (23.6% of 110.96/107.47) but needs more evidence of reversal which would be signaled on lift above 108.81 (Fibo 38.2%) and daily Kijun-sen (109.22).

Res: 108.54; 108.81; 109.22; 109.63

Sup: 108.00; 107.75; 107.47; 107.00