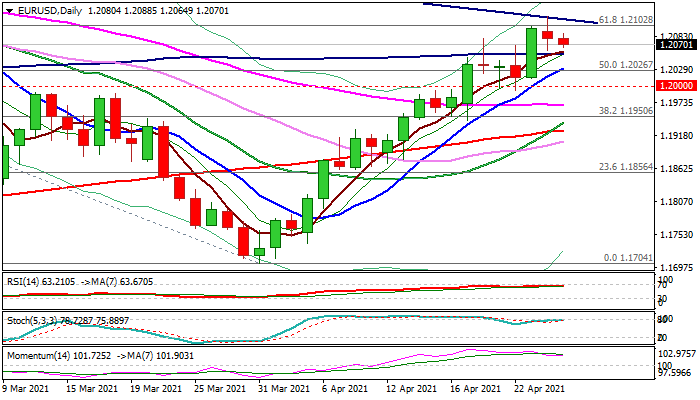

Bulls are consolidating ahead of fresh push through pivotal 1.21 resistance zone

Bulls are taking a breather after Monday’s failure to clearly break through important Fibo barrier at 1.2102 (61.8% of 1.2349/1.1704) and the action was capped by bear-trendline (1.2114) connecting tops at 1.2349 and 1.2242.

Monday’s daily candle with long shadows on both sides warn of indecision, with shallow dips seen so far, suggesting that bids are strong and larger uptrend from 1.1704 (Mar 31 low) remains intact.

Last Friday’s close above daily cloud was strong bullish signal which adds to positive outlook, as the pair last time briefly traded above the cloud in late February.

Multiple bull-crosses of daily moving averages and relatively strong bullish momentum on daily chart support the action.

Monday’s low (1.2061) and 100DMA (1.2052) mark initial supports, followed by daily cloud top (1.2039) and rising 10DMA (1.2029) which should limit extended dips ahead of fresh push higher.

Clear break of 1.21 zone (cracked Fibo 61.8% / trendline resistance) would signal bullish continuation and expose 1.2197 (Fibo 76.4% of 1.2349/1.1704).

Res: 1.2088; 1.2102; 1.2116; 1.2149

Sup: 1.2061; 1.2052; 1.2039; 1.2000