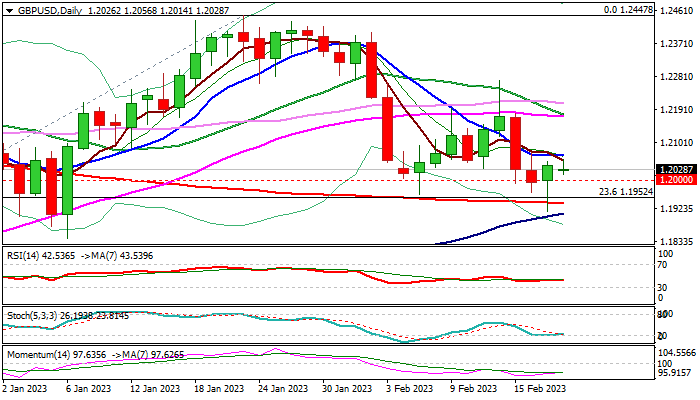

Bear-trap under 200DMA looks for more upside action to be confirmed

Cable remains constructive at the start of the week, although with limited upside so far, following Friday’s bullish daily candle with long tail, which generated positive signal on strong downside rejection under pivotal 200DMA support (1.1937) and possible bear-trap.

On the other hand, two consecutive weekly Dojis signal strong indecision and lack of direction, which is additionally supported by conflicting signals from daily chart.

Pivotal points lay at 1.1937 (200DMA) and 1.2092/1.2104 (daily Tenkan-sen / cloud top) with break of either side to generate fresh direction signal.

Traders focus on UK PMI data on Tuesday, which would provide fresh information about the condition of Britain’s economy.

Res: 1.2069; 1.2104; 1.2180; 1.2181

Sup: 1.2000; 1.1952; 1.1937; 1.1908