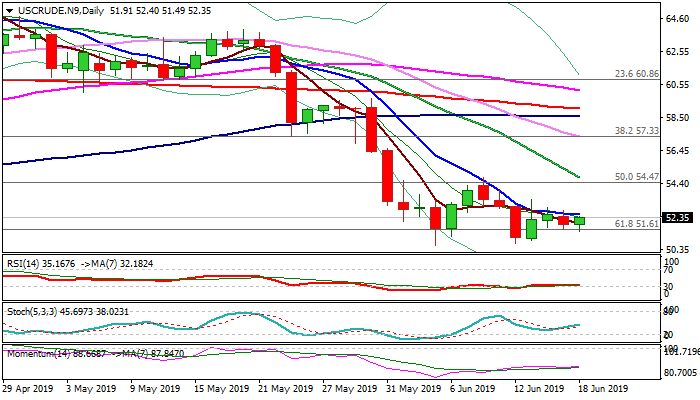

Bearish bias below 10SMA

WTI oil price holds within narrow range on Tuesday and remains below 10SMA, which capped the action in past four days, maintaining bearish near-term bias.

Fundamentals remain unchanged, with rising concerns over global economy slowdown that would decrease demand, maintaining pressure on oil prices.

On the other side, recent tensions between the US and Iran, partially offset negative impact and keep oil price afloat.

Technical studies remain bearish on daily chart and keep risk of retesting key supports at $50.59/71 (5/12 June lows) while 10SMA caps.

Only sustained break above 10SMA ($52.83) would ease pressure ad allow for stronger recovery.

OPEC+ meeting about extension of existing production cut deal has been delayed from original 26 June schedule, with members of cartel in talks about the new date (likely 10-12 July).

API crude stocks report is due later today and EIA report on Wednesday, with releases expected to give fresh signals.

Res: 52.53; 52.96; 53.43; 54.02

Sup: 51.49; 51.17; 50.71; 50.59