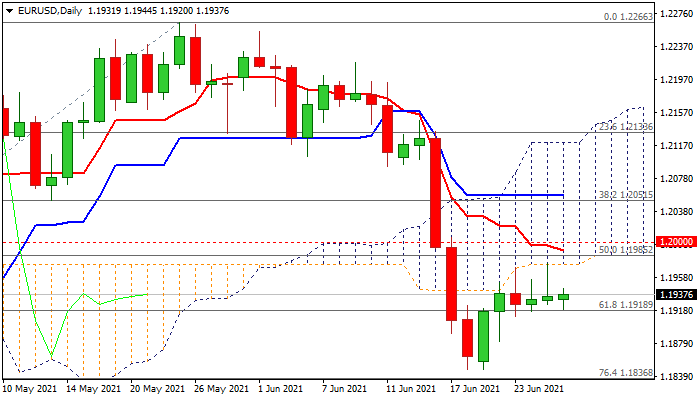

Bearish bias below thick daily cloud

The Euro remains in a choppy mode as the action stays capped under thick daily cloud, with long upper shadow on Friday’s candle pointing to strong upside rejection and keeping the downside vulnerable.

Bearish setup of daily moving averages, persisting negative momentum and the price action weighed by thick daily cloud, keep in play risk of recovery stall and bearish resumption towards 1.1836 (Fibo 76.4% of 1.1704/1.2266), break of which to risk acceleration towards 1.1704 (2021 low, posted on Mar 31).

On the other side, weekly studies are bullishly aligned and the price action is supported by a massive weekly cloud (cloud top lays at 1.1865), keeping in play hopes of fresh advance.

Violation of daily cloud base (1.1974) and break of other key barriers at 1.1994/1.2000 (200DMA / psychological) is needed to bring bulls in play and shift focus higher.

Res: 1.1974; 1.1994; 1.2000; 1.2051

Sup: 1.1911; 1.1865; 1.1847; 1.1836