Bearish pressure after dovish ECB could increase on upbeat US GDP data

The Euro is consolidating after strong fall on Thursday when it fell 103 pips after dovish ECB disappointed traders.

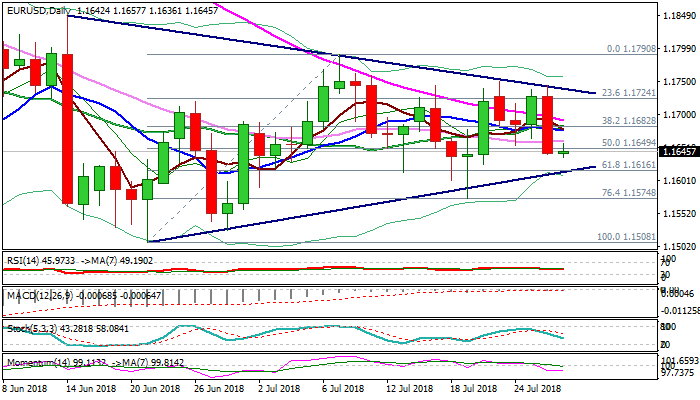

Strong fall and close below the base of thick daily cloud, following unsuccessful cloud penetration, was bearish signal.

Fresh bears pressure key support at 1.1616 (Fibo 61.8% of 1.1508/1.1790 recovery / triangle support) break of which would generate strong bearish signal and confirm negative near-term outlook for test of supports at 1.1574 (19 July spike low) and 1.1527 (28 June trough)

Daily techs are in firm bearish configuration and support scenario.

Better than expected German Import data, released earlier, provided little support, with focus turning towards release of US Q2 GDP data, due later today.

US Gross Domestic Product is forecasted for strong rise in Q2 (4.1% vs 2.0% in Q1) with upbeat release to boost dollar and increase bearish pressure on the single currency, which may revisit key supports at 1.1508 (21 June / 29 May lows).

Res: 1.1662; 1.1691; 1.1750; 1.1790

Sup: 1.1636; 1.1616; 1.1574; 1.1527