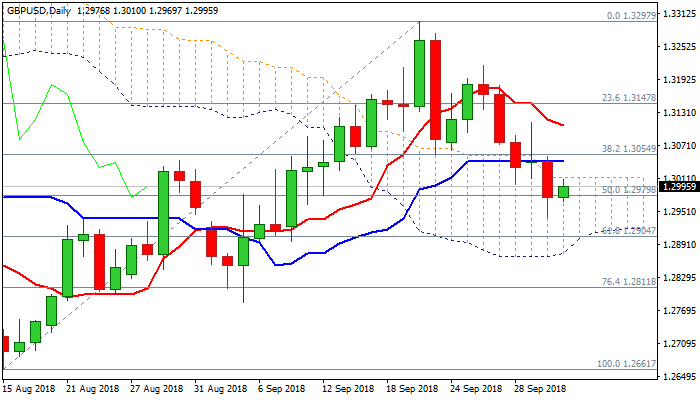

Bearish structure favors limited recovery ahead of fresh weakness

Cable moved higher and regained 1.30 handle in early Wednesday’s trading, after previous day’s bearish acceleration stalled at 1.2940.

Pound followed Euro’s recovery on news from Italy, but limited upside attempts could be likely scenario, as daily techs are negative and maintain bearish momentum, while rising uncertainty over Brexit continues to weigh.

Traders fear of Britain leaving EU without economic agreement, which could have strong negative impact on sterling.

Recovery faces strong headwinds from 1.30 zone (psychological barrier / daily cloud top at 1.3012), with extended upticks to be capped by 20SMA (1.3075) to keep bearish structure intact.

Repeated close below 55SMA would generate initial bearish signal for attack at pivotal 1.2904 support (Fibo 61.8% of 1.2661/1.3297 rally / daily cloud base) break of of which would spark further bearish acceleration.

Res: 1.3012; 1.3054; 1.3075; 1.3119

Sup: 1.2969; 1.2940; 1.2904; 1.2811