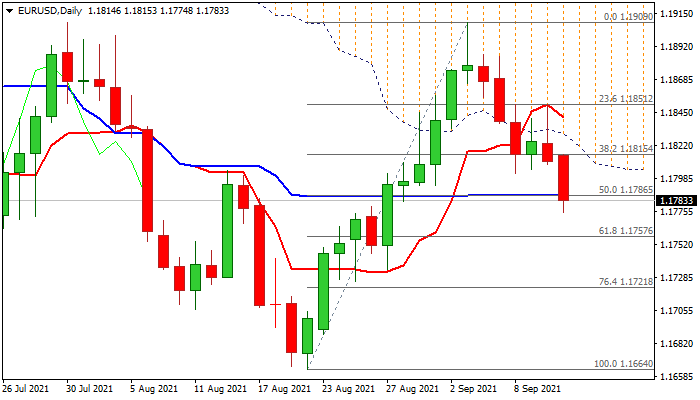

Bears accelerate under thick daily cloud

The Euro starts week in red and extends weakness below 1.18 mark in early Monday trading.

Fresh bears emerged after Sep 3 bull-trap above 1.1894 Fibo barrier (38.2% of 1.2266/1.1664) and gained pace after return below thick falling daily cloud which weighs on near-term action.

Near-term structure weakened further after Monday’s acceleration broke below daily Kijun-sen / 50% retracement of 1.1664/1.1909 upleg (1.1786), with close below here to add to reversal signals.

Daily studies show fading bullish momentum and MA’s turning to bearish setup, contributing to negative near-term outlook.

Bears eye initial target at 1.1751 (Fibo 61.8%) break of which to confirm reversal ad risk drop to 1.1721/00 (Fibo 76.4% / psychological).

Broken Fibo 38.2% of 1.1664/1.1909 upleg (1.1815) reverted to solid resistance which needs to keep the upside limited and maintain bearish bias.

Res: 1.1800; 1.1815; 1.1834; 1.1851

Sup: 1.1774; 1.1757; 1.1721; 1.1700