The dollar index is set for acceleration through 93 resistance zone

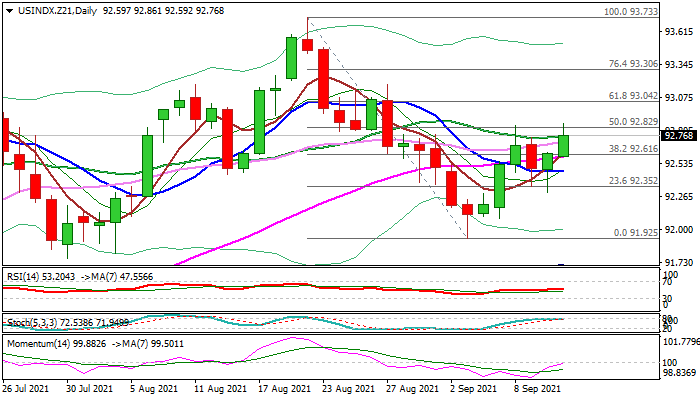

The dollar index rose to a three-week high on Monday, extending recovery from early September’s bear trap under Fibo support at 92.11 (38.2% of 89.50/93.73 rally).

Fresh bulls emerged above rising thick daily cloud and near-term action gained support, along with rising momentum on daily chart, which is about to break into positive territory, while moving averages turn into positive configuration.

Bulls look for an initial signal on close above former recovery high (92.84) that would open way for acceleration through 93.00 zone (psychological / Fibo 61.8% of 93.73/92.92 pullback) and expose targets at 93.30 (Fibo 76.4% / Aug 23 high).

Rising 55DMA limits today’s action and marks pivotal support at 92.60, which is expected to keep the downside protected.

Res: 92.86; 93.04; 93.30; 93.48

Sup: 92.60; 92.47; 92.30; 92.08