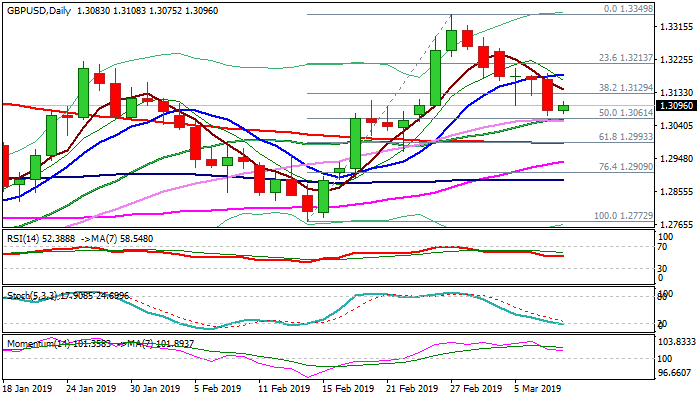

Bears are taking a breather ahead of probe through 30SMA and attack at key 200SMA support

Cable consolidates above strong supports at 1.3050 zone (converged 20/30SMA’s) approached on Thursday’s bearish acceleration through pivotal 1.3129 Fibo support (38.2% of 1.2772/1.3349 rally) that resulted in daily fall of 0.65%.

Sterling was pulled lower by Euro’s weakness and Brexit uncertainty ahead of Tuesday’s key vote on Brexit plan and on track for bearish weekly close and weighed by thickening and falling weekly Ichimoku cloud.

Weaker daily momentum could add to negative outlook but further hesitation on approach to 1.3050 pivots could be anticipated on oversold stochastic and neutral RSI.

Corrective upticks should ideally hold below broken Fibo support / 5SMA (1.3129/40) to keep bears intact and guard upper pivot at 1.3182 (10SMA).

Eventual break below 1.3150 would risk test of key support at 1.2993 (200SMA / Fibo 61.8% of 1.2772/1.3349).

Repeated close below weekly cloud base (1.3248) would also add to negative signals.

Res: 1.3108; 1.3129; 1.3140; 1.3182

Sup: 1.3068; 1.3050; 1.3012; 1.2993