Bears consolidate above key supports, awaiting fresh signals from US data

Bears are taking a breather after steep fall in past two days as dollar was hit by downbeat US Manufacturing PMI data and weaker than expected US private sector jobs report that raised concerns about US economic growth slowdown and fueled expectations for Fed rate cut in central bank’s next meeting at the end of October.

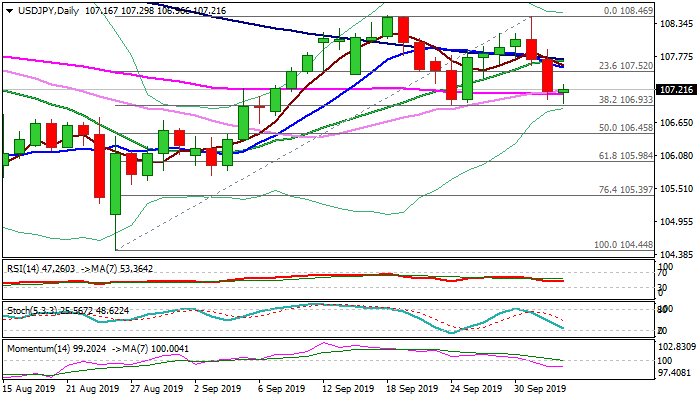

Fresh weakness faced strong headwinds from key supports at 106.96/98 (24/25 Sep double-bottom); 106.93 (Fibo 38.2% of 104.44/108.46) and 106.88 (daily cloud top).

Early Thursday’s action bounces to session high at 107.30, following repeated rejection above a cluster of key supports that raises hopes of further recovery and signal formation of higher base at 106.96.

Bullish dollar’s short-term stance has been dented by recent weak data, with markets looking for more evidence that would be provided by today’s release of US Non-Manufacturing PMI (Sep 55.0 vs 56.4% prev) and Friday’s Non-Farm Payrolls (Sep NFP 145K f/c vs 130K prev; Sep AHE 0.3% f/c vs 0.4% prev; Sep unemployment unchanged at 3.7%).

Weaker than expected readings would bring dollar under fresh pressure and risk dip through daily cloud (106.88/106.23), while recovery would accelerate if data surprise at the upside.

Res: 107.29; 107.52; 107.71; 107.89

Sup: 106.96; 106.88; 106.62; 106.45