Bears consolidate after strong fall on Monday; German ZEW data not expected to impact overall bearish picture

The Euro holds in recovery mode in early Tuesday’s trading after suffering strong losses on Monday (down 0.9% for the day in the biggest one-day fall since 27 Sep).

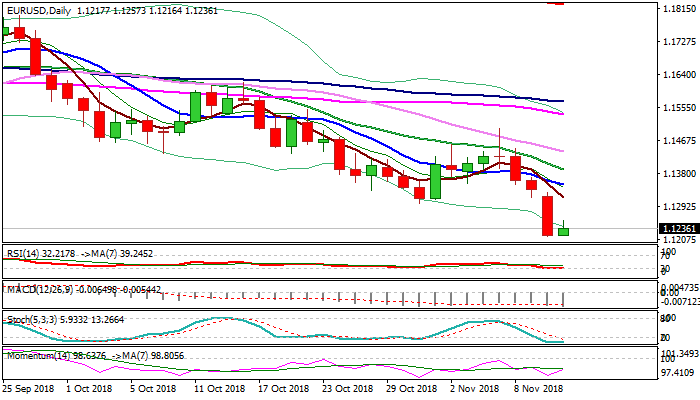

Bounce from new multi-month low at 1.1215, posted on Monday, showed limited upside action as overall picture remains negative.

The story of Italy’s budget continues to weigh strongly on EURUSD pair, with additional pressure on interest rate divergence; bearish techs and persisting fears over US/China trade conflict.

German Oct CPI came in line with expectations, with immediate focus turning on German ZEW economic sentiment data (Nov -24.2 f/c vs -24.7 prev) which could boost recovery on better than expected release.

Overall picture remains bearish, suggesting limited recovery before bears re-take control.

Former key supports at 1.1300 zone now mark solid resistance, ahead of falling 10SMA (1.1351) which is expected to cap extended upticks and keep bears intact.

Res: 1.1257; 1.1300; 1.1315; 1.1351

Sup: 1.1215; 1.1186; 1.1109; 1.1075